The Act may also help rein in unreasonable prices, making health care more affordable for everyone. Under the law, patients will no longer receive surprise medical bills, which have sometimes amounted to thousands of dollars. Will the No Surprises Act make health care more affordable? Those providers will have to negotiate a rate with the patient’s insurer or work with a third party to come to a decision. Out-of-network emergency and some other facility-based health care providers can no longer “balance bill” a patient. That doctor could, before the law passed, bill the patient for the difference between what insurance typically pays and what they charge.

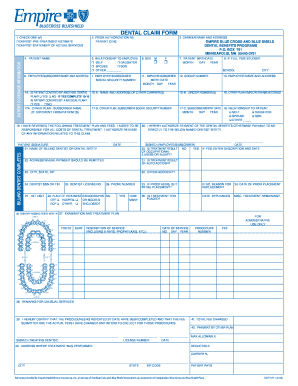

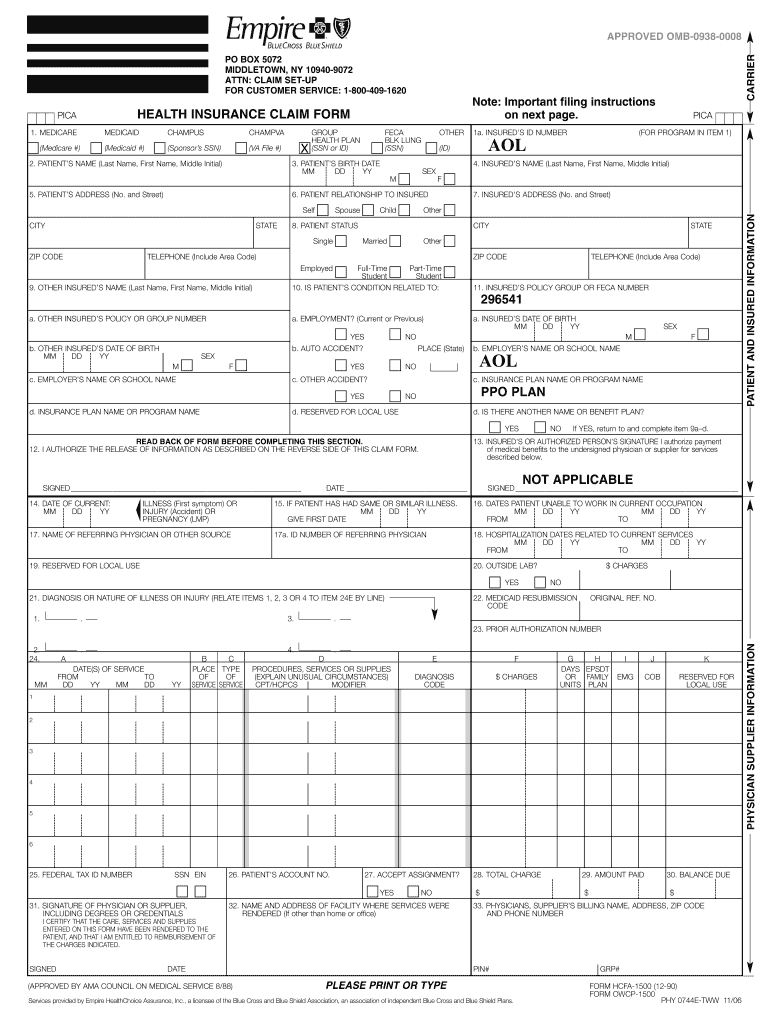

For example, a patient could be taken to an in-network hospital but treated by an out-of-network anesthesiologist. But there may be no time to choose in an emergency or a patient may not know about other providers who treat them while they're admitted. Patients can usually choose an in-network provider. The balance is what’s owed after insurance has paid their part of the claim. For any questions, you can call the customer service number on the back of your member ID card or on your plan's website,” said Sean Robbins, Executive Vice President, External Affairs, Blue Cross Blue Shield Association.” What’s a surprise bill?Ī surprise bill is an unexpected bill patients receive for the balance owed to an out-of-network facility or health care provider for certain facility-based services. “This law protects patients from unexpected and costly bills, while also taking meaningful steps to build a more affordable, transparent health care system. The idea behind the No Surprises Act is that they shouldn’t be penalized for it. Patients aren’t always able to choose an in-network provider. These providers could include a doctor a patient didn't choose themselves, an air ambulance or even the facility itself for emergency services. The No Surprises Act includes provisions to protect patients from having to pay an unexpected amount for facility-based services provided by certain out-of-network health care providers. Blue Cross and Blue Shield health plans stand behind these bipartisan-backed protections. It protects patients from receiving surprise medical bills. All these are also available when you log in to To Find a Preferred Provider for either PPO:Ĭentral and Western New York and outside New York State:Įnter the Member section of the Empire Blue Cross Web site and click on "Find a Doctor," then click on "Across the Country."Įnter the Member section of the Empire Blue Cross Web site and click on "Find a Doctor," then click on "Empire's Local Area."įor additional information regarding Health Benefits, please refer to Health Care section of the Benefits Handbook or Postdoctoral Benefits Handbook.A new law called the No Surprises Act went into effect on January 1st, 2022. See the gym reimbursement brochure for additional information. The PPO Benefits Guide will contain Your Benefits at a Glance that outlines for you in chart format an overview of your coverage, including in-network and out-of-network benefit levels general information about the provider network and benefits sections that describe in detail the health care services covered under the PPO Plan.įor both PPO plans are administered by Express Scripts, and have the same copayments for both plans.īoth plans offer a gym membership fee reimbursement of up to $400 annually. If you enroll in either PPO plan, you will receive a Benefits Guide from your campus benefits office. For the Deductible PPO, your deductible and coinsurance is lower for in-network services and there is a copayment for office visits. For the traditional PPO, with most types of care received in-network, you pay only a copayment at the time you receive services (within plan limits). The plan gives you the flexibility to visit any providers you choose, but visiting in-network providers can save you money and the time associated with filing claims for reimbursement. These in-network providers agree to charge reduced fees to plan participants, and the plan pays a higher percentage of the cost of care received from these providers. In a PPO plan, hospitals, physicians, and other health care providers agree to join the plan's provider network. The Traditional and Deductible PPO Plans provide benefits for you and your covered dependents through Empire Blue Cross.

0 kommentar(er)

0 kommentar(er)